11.12.2009

Policy Points

In articles describing the newest UNC Charlotte Economic Forecast, state media outlets have adopted the idea that the state’s economy is improving. And while that may be true on some levels (and if forecasts prove accurate), that “recovery” will do little to put a dent in state and local unemployment rates anytime soon.

Since the start of the recession, the state’s non-agricultural employers have eliminated 238,100 more positions than they have created. Not only have employers eliminated jobs, but they also have failed to create the minimum number of positions needed to accommodate the natural growth of the state’s workforce. So when the recovery starts, the state will need to recapture the jobs that were lost and the ones that were needed yet never created.

Yet there is little evidence that this will happen anytime soon. In fact, the UNC Charlotte forecast suggests that the entire state will only gain, on net, 32,800 net jobs in 2010. That is a numbing statistic as that level of job creation is insufficient to accommodate population growth, let alone offset some the losses that have occurred since December 2007. Consequently, the problems of unemployment and joblessness only will mount in 2010, and those mounting problems likely will further retard growth and further extend the time to a full recovery years into the future.

10.12.2009

Policy Points

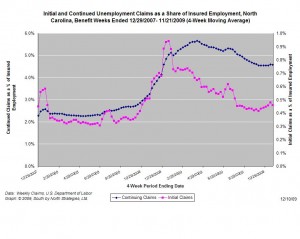

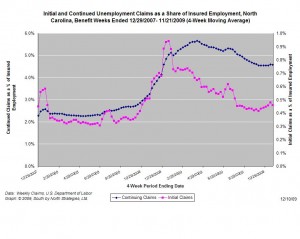

For the benefit week ending on November 21st, 13,868 North Carolinians filed initial claims for unemployment insurance, and 177,515 individuals applied for continuing insurance benefits. Compared to the prior week, there were fewer initial and continuing claims; however, this is partly due to the fact that the filing week contained fewer than five workdays owing to the Thanksgiving holiday. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 18,147 initial claims were filed over the last four weeks, along with an average of 181,033 continuing claims. Compared to the previous four-week period, both initial and continuing claims were somewhat lower.

One year ago, the four-week average for initial claims stood at 20,437 and the four-week average of continuing claims equaled 130,567.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Although new and continuing claims appear to have peaked for this business cycle, the claims levels remain elevated and point to a labor market that remains extremely weak. Especially troubling is the high level of continuing claims, which suggests that unemployed individuals are finding it extremely difficult to find new positions.

10.12.2009

Policy Points

Economic policy reports, blog postings, and media stories of interest:

10.12.2009

Policy Points

From the Economic Policy Institute’s analysis of the latest Job Openings and Labor Turnover Survey …

The latest Bureau of Labor Statistics report on Job Openings and Labor Turnover Survey (JOLTS) shows that the number of new job openings decreased by 80,000 in October to 2.5 million. At the same time, however, the number of unemployed workers increased by 558,000 to 15.7 million. As a result, there were 13.2 million more unemployed workers than job openings in October, or 6.3 job seekers per available job …. Given the large number of job seekers per job opening, it is unsurprising that the jobless are getting stuck in unemployment for long periods and that the labor market is seeing record rates of long-term unemployment.

10.12.2009

Policy Points

Economist Brad DeLong discusses the debate about job creation the country should be having:

Right now, if you ask the decisive members of congress—by which I mean the Blue Dog Democrats in the House, or the most conservative Democrats and most liberal Republicans in the Senate —why the president and the Congress are not doing more to reduce unemployment and boost spending and income, the answer you’ll get is … well, you probably wouldn’t get an intelligible answer.

…

But if you did get an explanation for the lack of congressional action it would go something like this: Attempts to move supply and demand in the market for savings in order to boost spending would (a) increase the national debt burden on future taxpayers and (b) lead to a large decline in bond prices and a boost in interest rates. Why? Because businesses would try to increase their liquidity to support higher spending, driving up interest rates, which, in turn, would cause businesses to cut back on investment, thus neutralizing most or all of the stimulative policies.

…

Similarly, if you were to ask the Federal Reserve why it isn’t doing more to reduce unemployment and boost spending and income, the answer you would get is this: Spending is in no way constrained by a shortage of liquidity. We have already done all we can do, indeed we have “flooded the zone” with liquidity. As a result, the Fed is disinclined to pursue additional tweaks of supply and demand in the market for liquidity because it fears such efforts would fuel destructive inflation in the future without boosting employment and spending in the present.

…

Both of these arguments are comprehensible; each might well be true. But they cannot both be true at the same time. Either the economy is so awash in liquidity that the Federal Reserve cannot do much to boost spending—in which case additional spending by the government won’t generate any substantial rise in interest rates. Or additional government spending will crowd out investment as businesses scramble for liquidity and interest rates rise—in which case the economy is not awash in liquidity, and quantitative easing by the Federal Reserve could do a lot right now to boost spending and employment.

…

It appears that what we have here is a failure to communicate.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed