Policy Points

22.10.2009

Policy Points

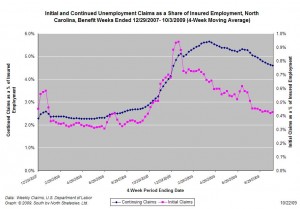

For the benefit week ending on October 3rd, 17,292 North Carolinians filed initial claims for unemployment insurance, and 180,235 individuals applied for continuing insurance benefits. Compared to the prior week, there were more initial and fewer continuing claims. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 17,040 initial claims were filed over the last four weeks, along with an average of 183,578 continuing claims. Compared to the previous four-week period, initial claims rose slightly and continuing claims fell slightly.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Although new and continuing claims appear to have peaked for this cycle, the claims levels remain elevated and point to a labor market that remains extremely weak.

22.10.2009

Policy Points

From the Federal Reserve Bank of Richmond’s September survey of manufacturing activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Manufacturing activity in the central Atlantic region expanded for the fifth straight month in September, according to the Richmond Fed’s latest survey. All broad indicators — shipments, new orders and employment — landed in positive territory, with manufacturers noting their first increase in worker numbers since December 2007. Other indicators were mixed, however. Capacity utilization grew more slowly, while backlogs and vendor delivery times shrank. In addition, manufacturers reported slower growth in inventories.

21.10.2009

Policy Points

Economic policy reports, blog postings, and media stories of interest:

21.10.2009

Policy Points

The seasonally-adjusted prices received by producers of finished goods fell by 0.6 percent in September, according to data recently released by the U.S. Bureau of Labor Statistics. That same month, the prices received by sellers of intermediate goods rose slightly (+0.2 percent), and the prices received by sellers of crude goods fell by 2.1 percent.

At each stage of the production process, price changes were attributable to declines in food and energy prices. When energy and food prices are excluded, producer prices for finished goods fell by 0.1 percent in September. Absent energy and food costs, producer prices rose for both intermediate and crude goods.

Over the past year, producer prices have fallen sharply. Unadjusted prices for finished goods have declined by 4.8 percent, and producer prices for intermediate and crude goods have dropped by 11.7 percent and 31.5 percent, respectively.

The new data offer two insights into the state of the American economy. First, the findings suggest that demand for good and services remains weak. Second, the report indicates that inflation is not currently a threat to the larger economy.

21.10.2009

Policy Points

From the Federal Reserve Bank of Richmond’s September survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Service sector activity remained soft in September, according to the latest survey by the Federal Reserve Bank of Richmond. The ongoing decline in retail sales slowed this month, and shopper traffic was down only slightly compared to a month earlier. In contrast, revenues dropped sharply at services firms. However, survey respondents remained optimistic about demand for their products and services over the next six months.

Service sector activity remained soft in September,

according to the latest survey by the Federal

Reserve Bank of Richmond. The ongoing decline

in retail sales slowed this month, and shopper

traffic was down only slightly compared to a month

earlier. In contrast, revenues dropped sharply at

services firms. However, survey respondents

remained optimistic about demand for their

products and services over the next six months.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed