America’s Foreign-Born Population, 1960-2010

A new set of infographics prepared by the US Census Bureau traces the changes in America’s foreign-born population between 1960 and 2010.

A new set of infographics prepared by the US Census Bureau traces the changes in America’s foreign-born population between 1960 and 2010.

The New York Times reports on new survey research showing that nearly a quarter of all Americans experienced a job loss at some point during the “Great Recession.

The survey presented a bleak view of the economic future.

…

A majority of Americans say they think it will be at least six years before the economy is made whole again, if ever. Three in 10 said the economy would never fully recover from the Great Recession.

…

“Despite significant improvements in the nation’s labor market, American workers’ concerns about unemployment, the job market, job security and the future of the economy have not changed much since we conducted a similar survey in August 2010,” the report said.

…

Just a third of Americans surveyed in this poll, conducted from Jan. 9-16, said they thought the economy would be better next year, the same share that said so two years earlier.

…

Of those laid off in recent years, nearly a quarter said they still had not found a job. Re-employment rates for older workers have been particularly bad, with nearly two-thirds of unemployed people 55 and older saying they actively sought a job for more than a year before finding one or had still not found work.

Writing in USA Today, economist Duncan Black explains why America’s grand experiment with 401(k) plans has ended in disaster.

The 401(k) experiment has been a disaster, a disaster which threatens to doom millions to economic misery during the later years of their lives. Proposals to improve our system of private retirement savings — even good ones — will offer little to no help for the baby boomers who are currently nearing retirement, and are also unlikely to be of sufficient help for current younger workers. We need to increase Social Security benefits, now and in the future. It’s the only realistic way to provide people with guaranteed economic security and comfort post-retirement.

Caroline Baum, a columnist for Bloomberg, doesn’t buy into the argument that “uncertainty” is the explanation for America’s economic problems.

Which brings me to the subject of uncertainty, the presumed source of all things ailing the U.S. economy. Uncertainty is omnipresent. No one speaks of uncertainty during good times. There was lots of uncertainty in March 2000, when the Nasdaq Composite Index breached 5,000 as investors bought shares of Internet companies with no revenue, no profits and, in at least one case, no known business. No uncertainty back then; just a case of irrational exuberance.

…

In good times, the word uncertainty rarely appears in policy discussions. In bad times, it’s the default setting. Why not call it by what it really is, which is pessimism? When businesses say they aren’t going to invest because of uncertainty, what they mean is, they don’t think their investments will produce a substantial profit.

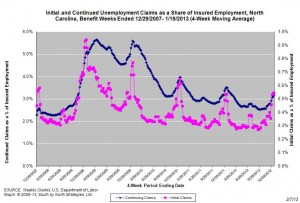

For the benefit week ending on January 19, 2013, some 16,175 North Carolinians filed initial claims for state unemployment insurance benefits and 113,584 individuals applied for state-funded continuing benefits. Compared to the prior week, there were more initial and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 20,681 initial claims were filed over the previous four weeks, along with an average of 119,625 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, as was the average number of continuing claims.

One year ago, the four-week average for initial claims stood at 18,083, and the four-week average of continuing claims equaled 131,057.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.8 million versus 3.7 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were five years ago.

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.