28.01.2010

Policy Points

From the Federal Reserve Bank of Richmond’s January survey of service-sector activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

The overall service sector weakened in January, damped by softness at services providers, according to the latest survey by the Federal Reserve Bank of Richmond. Retail sales were nearly flat for the month, although big-ticket sales remained in decline. For the first time since December 2007, shopper traffic rose. Merchants’ inventories also increased slightly in January. In contrast to the strengthening at retail establishments, however, revenues at services firms fell this month. Even so, survey respondents overall were upbeat about business prospects for the six months ahead.

…

The number of employees continued to shrink in the service sector, but the decline slowed at retail establishments. Average wages were virtually unchanged, and service sector price growth slowed. Expectations were for price increases during the coming six months to be somewhat slower than anticipated in last month’s outlook.

27.01.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

27.01.2010

Policy Points

From the Federal Reserve Bank of Richmond’s January survey of manufacturing activity in the South Atlantic (District of Columbia, Maryland, North Carolina, South Carolina, Virginia and West Virginia):

Manufacturing activity in the central Atlantic region contracted at a less pronounced rate in January, according to the Richmond Fed’s latest survey. The index of overall activity edged up a bit as growth in new orders turned slightly positive. Growth in shipments contracted at a somewhat slower pace, while employment contracted at a slightly quicker rate. Other indicators were also mixed. The pace of decreasing backlogs and capacity utilization were on par with December, while vendor delivery times increased. In addition, manufacturers reported slightly slower growth in inventories.

…

Looking forward, assessments of business prospects for the next six months were generally in line with last month. Firms anticipated that their shipments, new orders, backlogs, and capacity utilization would grow more rapidly in the months ahead.

27.01.2010

Policy Points

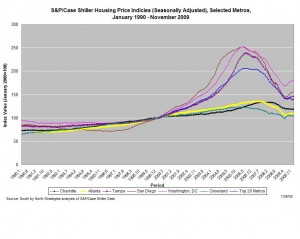

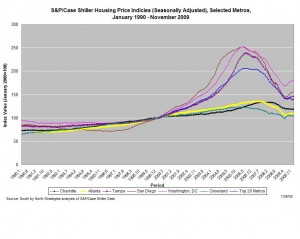

In October, the seasonally-adjusted home prices of single-family units rose in 19 of the 20 metro areas tracked by the S&P/Case-Shiller Housing Price Indicies. Despite those increases, sales price levels in 15 markets remain lower than they were one year ago.

The graph (right) shows changes in price indices for selected metros. Data are shown for Charlotte, certain peer metros in the South Atlantic, and, for purposes of regional comparisons, San Diego and Cleveland. The composite measure for all 20 metros also is shown.

While Charlotte never experienced the same housing bubble seen in other metros, housing prices, as measured by the index, have fallen by 5.6 percent over the past year and by 10.8 percent since the start of the recession. And Charlotte was one of 19 metros tracked in the survey that recorded a month-to-month increase in prices. Although most of the price tracked by the S&P/Case-Shiller Indicies have risen over the past few months, those trends don’t necessarily mean that the housing bubble has fully deflated. Explains Calculated Risk:

The impact of the massive government effort to support house prices led to small increases in prices over the Summer, and the question is what happens to prices as these programs end over the next 6 months. I expect further price declines in many cities.

26.01.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed