22.01.2010

Policy Points

A round-up of policy reports from the week ending on 1/22:

22.01.2010

Policy Points

The December employment report released today by the Employment Security Commission contains few signs of a recovery in the job market. Since the start of the recession in December 2007, North Carolina has lost six percent of its payroll employment base and has seen its unemployment rate climb to a modern high of 11.2 percent.

In December, North Carolina employers shed 2,400 more positions than they added. The public sector gained, on net, 800 positions, and the private sector cut, on net, 3,200 positions. Among private industries, leisure and hospitality services eliminated the most positions (-2,600), followed by manufacturing (-900), and trade, transportation and warehousing (-800). Professional services posted the largest numerical gain (+1,900), followed by government (+800), and information (+600). Furthermore, an upward revision to the November report reduced total net job losses for that month from 5,600 to 2,400.

Click here to read South by North Strategies analysis of the December employment report.

22.01.2010

Policy Points

The Bureau of Labor Statistics’ report on inflation-adjusted worker earnings in December 2009 shows that workers are losing ground due to declines in average hourly earnings and average weekly hours.

Real average hourly earnings did not change from November to December, seasonally adjusted, the Bureau of Labor Statistics reported today. A 0.2 percent increase in average hourly earnings for production and nonsupervisory workers was offset by a 0.2 percent increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Real average weekly earnings was unchanged over the month, seasonally adjusted. This stems from no change in real average hourly earnings and in average weekly hours. Since reaching a recent high point in December 2008, real average weekly earnings have fallen by 1.6 percent.

Real average hourly earnings fell 1.3 percent, seasonally adjusted, from December 2008 to December 2009. A 0.3 percent decline in average weekly hours combined with the decrease in real average hourly earnings resulted in a 1.6 percent decrease in real average weekly earnings during this period.

21.01.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

21.01.2010

Policy Points

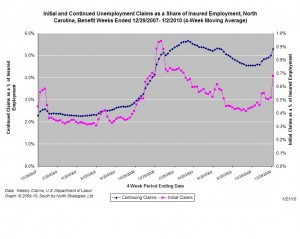

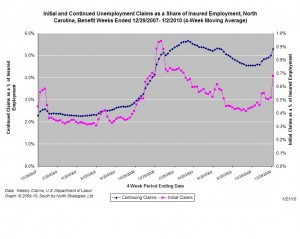

For the benefit week ending on January 2nd, 43,328 North Carolinians filed initial claims for state unemployment insurance benefits, and 234,727 individuals applied for state-funded continuing insurance benefits. Compared to the prior week, there were fewer initial and continuing claims. (Note the previous filing week had fewer business days due to the New Year’s holiday.) These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 26,738 initial claims were filed over the last four weeks, along with an average of 208,010 continuing claims. Compared to the previous four-week period, both initial and continuing claims were higher.

One year ago, the four-week average for initial claims stood at 35,515 and the four-week average of continuing claims equaled 184,667.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Although new and continuing claims appear to have peaked for this business cycle, the claims levels remain elevated and point to a labor market that remains extremely weak. Especially troubling is the high level of continuing claims, which suggests that unemployed individuals are finding it extremely difficult to find new positions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed