12.01.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

12.01.2010

Policy Points

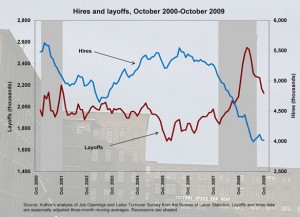

A data snapshot from the Economic Policy Institute finds that job layoffs have moderated but hiring has not yet picked up.

12.01.2010

In the News, Policy Points

A recent story in The Charlotte Observer looks the issues that are driving increasing numbers of jobless workers to accept jobs that pay less than their previous ones. This is a function of weak labor market conditions. As South by North Strategies’ John Quinterno explained in the piece:

“You reach a point where, for some folks, they pretty much have to make the choice that some job is better than no job, even if they have to take a cut in pay or benefits,” said analyst John Quinterno of Chapel Hill research firm South by North Strategies Ltd.

Later in the same piece, he elaborated further:

Quinterno, the Chapel Hill analyst, said job seekers are becoming increasingly desperate. There are more than six candidates for every available position nationwide – and that means they’ll have limited bargaining power when it comes to salary, he said.

11.01.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

11.01.2010

Policy Points

One consequence of the current recession has been a significant loss of retirement wealth for the subset of Americans holding equities in IRAs, 401(k)s, and other tax-advantaged retirement savings accounts. A new analysis posted at TaxVox estimates how long it would take for portfolios to recover under various growth scenarios. The answers are not encouraging.

The post also highlights a frequently overlooked aspect of retirement saving: the class dimension. Severe stock market losses tend to inflict a higher price on older and wealthier households. Notes the blog:

Keep in mind that there will be big differences in how the crash affects individuals’ retirement prospects, depending on their age and income. Older people are likely to lose more because they had more invested before the crash and have less time to recover their losses before they retire. But younger people may benefit because they’ll have the chance to buy stocks at bargain prices. Because the wealthy are likely to own more stocks, they’ll lose more if the market does not bounce back, but gain more if it recovers. In contrast, low and middle-income individuals own few stocks and rely mostly on Social Security for their retirement. They are little affected by the market crash and most can recover their losses by working for an additional year.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed