Policy Points

11.11.2009

Policy Points

Recent years have seen a burst in public, private, nonprofit, and philanthropic efforts designed to help low-income young adults acquire postsecondary credentials and career-relevant skills. For instance, the Bill and Melinda Gates Foundation is seeking to double the number of low-income students who earn a meaningful postsecondary credential by age 26.

Unfortunately, the sheer volume of programmatic and policy activities has led to to confusion over what works and how effective programs could be structured. To bring clarity to the discussion, The Workforce Strategy Center, a New York-based research firm, recently published a typology of innovative efforts.

The center scanned existing practices and identified those that met four criteria: 1) help low-income students earn meaningful postsecondary credentials; 2) partner with employers in industries relevant to regional economies; 3) cultivate employer involvement and commitment; and 4) demonstrate portability, scalability, and replicability.

Using those criteria, the center then identified 14 major models that can be classified by organizational type, target populations, target industries, location, governance, funding, scale, and outcomes. In general, concludes the study, successful efforts share certain common features, including the following:

read more

11.11.2009

Policy Points

Between November 5 and November 17, Policy Points will be updated on a reduced schedule. During that time, the blog will be updated once per weekday at approximately 8 AM. Posting will return to a three-per-weekday schedule on November 18.

Also, remember that Policy Points is available as an RSS feed. Click here to subscribe using any number of popular RSS readers.

10.11.2009

Policy Points

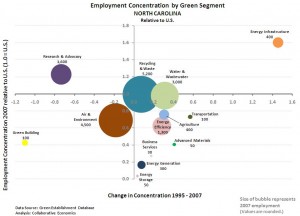

A recent study commissioned by the National Governors Association analyzed the size and scope of the “green economy” in each of the 50 states. For the purposes of the study, the green economy was defined as businesses that produce products or services that provide alternatives to carbon-based energy, conserve the use of resources, or reduce pollution and waste.

As the graph (below) illustrates, North Carolina’s economy enjoys competitive advantages in the areas of energy infrastructure, sustainable agriculture,, energy efficiency, alternative transportation, and water management. In all of these green fields, North Carolina has experienced an increasing concentration of employment opportunities since 1995.

09.11.2009

Policy Points

A new policy brief from the Working Poor Families Project proposes ways to improve the educational programs offered to adult inmates of state prisons. Argues the brief:

Inmates in state prisons have significantly lower levels of

educational attainment than the general population. About 40

percent of state prison inmates lack a high school diploma or

GED5 compared to 13.7 percent of all adults ages 18 to 64.6 Only

11 percent of state inmates have taken any college-level or

postsecondary vocational classes.7 According to results from the

National Adult Literacy Survey, prisoners also have a

substantially lower level of literacy than the U.S. population as a

whole.8 Prior to incarceration, prison inmates are more likely

than the general population to be unemployed and to be living in

poverty.9

Inmates in state prisons have significantly lower levels of educational attainment than the general population. About 40 percent of state prison inmates lack a high school diploma or GED5 compared to 13.7 percent of all adults ages 18 to 64. Only11 percent of state inmates have taken any college-level or postsecondary vocational classes. According to results from the National Adult Literacy Survey, prisoners also have a substantially lower level of literacy than the U.S. population as a whole. Prior to incarceration, prison inmates are more likely than the general population to be unemployed and to be living in poverty.

—

Educational programming has been a part of the U.S. prison system throughout its history. Support for prison education programs reached its peak during the 1970s when policymakers viewed education as an important part of prisoners’ rehabilitation. However, support among policymakers and the public waned in the 1980s and funding for education in prisons underwent significant cuts.

read more

06.11.2009

Policy Points

This morning, the U.S. Bureau of Labor Statistics released the national employment report for the month of October.

Both the commissioner’s statement on the October payroll and household surveys and the full employment situation report are available for online viewing.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed