08.10.2009

Policy Points

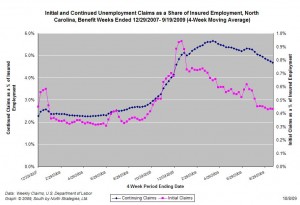

For the benefit week ending on September 19th, 16,437 North Carolinians filed initial claims for unemployment insurance, and 184,051 individuals applied for continuing insurance benefits. Compared to the prior week, both initial and continuing claims were lower. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 17,241 initial claims were filed over the last four weeks, along with an average of 187,377 continuing claims. Both levels were down slightly compared to the previous four-week period.

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start (12/07).

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start (12/07).

Although new and continuing claims appear to have peaked for this cycle, the claims levels remain elevated and point to a labor market that remains extremely weak.

07.10.2009

Policy Points

Economic policy and media reports of interest:

07.10.2009

Policy Points

In a press release today, Dell, Inc. announced that it will be closing its computer assembly facility in Winston-Salem, NC. According to the company, 600 positions will be eliminated next month, and another 300 will be eliminated by early next year.

When the plant opened in 2005, it was the recipient of state and local tax subsidies valued at close to $300 million.

07.10.2009

Policy Points

From the latest issue of the Center for Economic and Policy Research’s Housing Market Monitor:

Whether or not the [first-time homebuyer tax]credit is extended, the outlook for the market in the near future is almost certain to darken. The number of mortgage delinquencies continues to rise. With the economy continuing to lose jobs and many homeowners having exhausted their savings and their unemployment benefits, there will certainly be more distressed sales in the future. In addition, it seems unlikely that interest rates will remain at the extraordinarily low levels that they have been at in recent months. We are approaching the end of the period in which the Fed has committed to buy mortgage-backed securities, so unless they extend their purchases, mortgage rates will almost certainly be rising in the next few months. In short, there are many factors suggesting that the housing market will weaken with more supply and weakened demand. There is really nothing pointing in the opposite direction.

07.10.2009

Policy Points

A report in today’s edition of The New York Times discusses interest in adoptng a federal tax credit targeted at firms that create new jobs — an idea last tried in the 1970s. Reports the Times:

One version of the approach, to be unveiled next week by the Economic Policy Institute, a labor-oriented research organization, would give employers a two-year tax credit if they increased the size of their work force or added significant hours of work (for example, making a part-time worker full time). Employers would receive a credit worth twice the first-year payroll tax for each new hire, amounting to several thousand dollars, depending on the new worker’s salary ….

Under the proposal … the credit in the first year would equal 15.3 percent of the cost of adding an employee. In the second year, it would fall to about 10.2 percent.

For example, hiring a worker might cost a small business $50,000 annually. But with the tax credit, the cost would fall to $42,350 in the first year, and then be $44,900 the next year. After that, the cost would return to $50,000.

read more

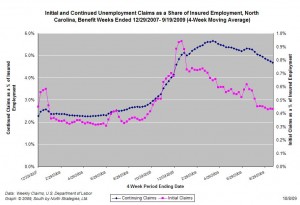

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start (12/07).

The graph shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start (12/07).

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed