Policy Points

06.10.2009

Policy Points

Economic and policy reports and media stories of interest on 10/6.

06.10.2009

Policy Points

Last week’s alarming national employment report has caused federal leaders to consider additional measures to spark job creation. Options reportedly under discussion include extending unemployment insurance benefits, providing tax credits to business that add positions, allowing businesses to carry back operating losses over a longer time period, and expanding and extending a tax credit for first-time homebuyers.

Unfortunately, none of these measures actually will have much of an impact on job creation and with the crucial excpetion of extending unemployment insurance benefits, none will do much to stimulate the economy.

Consider the first-time homebuyers tax credit, which some advocates want to extend and expand. In its current form, the tax credit is not only expensive and inefficient, but it also does nothing to reduce the the nation’ supply of excess housing units. Calculated Risk explains:

The so-called “first-time” homebuyer tax credit just moves people from renting to owning, and doesn’t reduce the overall number of excess housing units. As I’ve noted before, the tax credit policy will push the rental vacancy rate above 11% soon ….

The new home market is definitely in a depression, and will not recover until the excess housing inventory is reduced. However most of the tax credit was aimed at the existing home market – and existing home sales are at about a normal level (not depressed), although the mix is skewed toward the lower end and distressed sales (not a healthy market).

read more

05.10.2009

Policy Points

The current issue of The New Yorker offers up an 11,000-word profile of Lawrence Summers, the director of the National Economic Council for the Obama administration.

Perhaps the most interesting section of the article authored by journalist Ryan Lizza is the discussion of how the size of the administration’s recovery package was determined:

On Tuesday, December 16, 2008, as five inches of snow fell on Chicago, Obama’s top advisers gathered in his transition headquarters to discuss the memo. Obama sat on one side of a large square table, and crowded around the three others were members of his incoming team: Biden; Summers; Rahm Emanuel, the chief of staff; David Axelrod, Obama’s senior adviser; Timothy Geithner, the Treasury Secretary; Christina Romer, the chair of the Council of Economic Advisers; Peter Orszag, the budget director; Jared Bernstein, Biden’s top economic adviser; and several more. Others, like Lee Sachs, a former Bear Stearns executive and Clinton Treasury official, who was an expert on the financial crisis and who later joined Geithner at Treasury, were brought in via teleconference. Summers led the meeting like an orchestra conductor, directing the other economic advisers, each of whom made a presentation.

read more

05.10.2009

Policy Points

Recent media accounts of economic issues assume that the worst of the recession is over and that the American economy is growing again. This view, however, is not supported by a majority of registered voters.

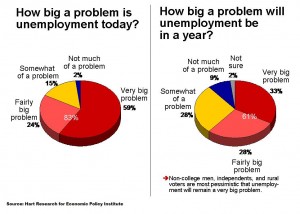

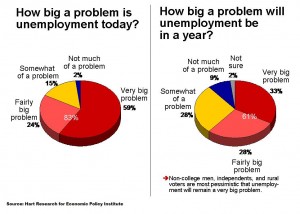

A recent survey sponsored by the Economic Po licy Institute found that 85 percent of American voters believe that the economy is still in a recession. Also, a majority of voters believes that unemployment is one of the two most important economic issues facing the country. Overall, 80 percent of voters see unemployment as a major problem, and 60 percent expect unemployment still will be a big story one year from now (graph).

licy Institute found that 85 percent of American voters believe that the economy is still in a recession. Also, a majority of voters believes that unemployment is one of the two most important economic issues facing the country. Overall, 80 percent of voters see unemployment as a major problem, and 60 percent expect unemployment still will be a big story one year from now (graph).

Additionally, this recession is a very personal one: 57 percent of voters are personally close to someone who has been laid off and 61 percent are close to someone who has experienced a reduction in hours or pay.

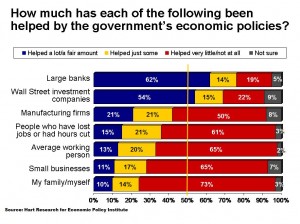

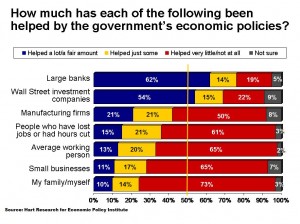

In terms of economic recovery, two-thirds of voters claim that that the federal recovery package has had a positive but minor impact. Instead, voters feel that the federal government’s actions have favored banks and Wall Street (graph).

In terms of economic recovery, two-thirds of voters claim that that the federal recovery package has had a positive but minor impact. Instead, voters feel that the federal government’s actions have favored banks and Wall Street (graph).

Going forward, voters say that more must be done to create jobs and aid the unemployed. Such efforts should take precedence over other issues like reducing the federal budget deficit.

05.10.2009

Policy Points

According to a new study sponsored by the Pew Research Center’s Project for Excellence in Journalism, media coverage of the ongoing recession has paid scant attention to the economic issues of greatest day-to day concern to average Americans: issues like unemployment, housing and foreclosures, state and local spending on public services, and family economic hardships.

Instead, the Pew study found that media coverage of economic issues has been dominated by three topics: efforts to aid large banks, the passage of the economic recovery act, and assistance to the auto industry. Most of the coverage of these topics originated in actions taken by governmental and business leaders. The majority of stories originated from New York City and Washington, D.C., and most focused on the perspectives of government officials, business leaders, and academic experts.

Alarmingly, the new research found that coverage of economic issues has dropped sharply since the end of March, which is when the stock market began to recover. In fact, coverage of economic issues has moved in an inverse relationship to the direction of the stock market. When the market began to rally in late March, the idea that the economy was improving took firm hold in media accounts and has shaped much subsequent coverage, even though recent data do not necessarily support that view.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed