Policy Points

05.12.2013

Policy Points

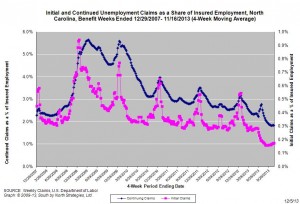

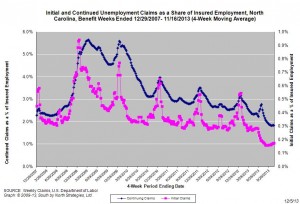

For the benefit week ending on November 16, 2013, North Carolinians filed some 6,848 initial claims for state unemployment insurance benefits and 71,846 claims for state-funded continuing benefits. Compared to the prior week, there were more initial claims and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 6,772 initial claims were filed over the previous four weeks, along with an average of 70,962 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, and the average number of continuing claims was higher.

One year ago, the four-week average for initial claims stood at 11,655, and the four-week average of continuing claims equaled 97,012.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.85 million versus 3.78 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were almost six years ago.

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. In fact, the four-week average of initial claims, when measured as a share of covered employment, is now near the lowest level recorded since early 2008. The four-week average of continuing claims also has fallen to near the lowest level recorded since early 2008.

Note that the recent declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1. In time, this development also should reduce the number of continuing claims. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that eventually should lead to a reduction in the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (6,772) was 41.9 percent lower than the figure recorded one year ago (11,655), while the average number of continuing claims was 26.9 percent lower (70,962 versus 97,012). Given the relative lack of improvement in labor market condition in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

22.11.2013

News Releases, Policy Points

CHAPEL HILL, NC (November 22, 2013) – The release of new state-level labor market information following a long delay caused the shutdown of the federal government provides little evidence that conditions have improved materially across North Carolina. While employers added 30,100 more payroll jobs (+0.7 percent) than they the eliminated between August and October, the size of the state’s labor force fell by 18,369 persons (-0.4 percent) during the same period. And the state’s labor force participation rate—a key measure of labor utilization—fell steadily over that time to the lowest monthly figure recorded at any point since 1976.

These findings come from new data released today by the Labor and Economic Analysis Division of the NC Department of Commerce.

“North Carolina’s labor market has experienced few meaningful improvements since August,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “Although the state experienced some job growth and saw a sharp drop in the unemployment rate, the decline in unemployment was attributable largely to people leaving the labor force rather than finding jobs. A tremendous amount of labor in North Carolina simply is sitting idle due to a lack of demand.”

Between August and October, North Carolina businesses gained 30,100 more jobs than they cut (+0.7 percent). Private-sector payrolls netted 19,200 positions (+0.6 percent), and public-sector payrolls added 10,900 jobs (+1.6 percent), due chiefly to hiring by local governments (+7,100, +1.7 percent). Within the private sector, the educational and health services sector netted the most jobs (+9,900, +1.8 percent), followed by the trade, transportation, and utilities sector (+7,000, +0.9 percent). The leisure and hospitality sector, meanwhile, lost the most jobs (-3,200, -0.7 percent), followed by the finance (-3,100, -1.5 percent) and construction (-1,800, -1.1 percent) sectors.

A revision to the August payroll data found that the state gained more jobs that month than first estimated (+2,900 versus -1,700). With that revision, North Carolina now has, on net, 81,000 fewer payroll positions (-1.9 percent) than it did in December 2007. Since bottoming out in February 2010, the state has netted an average of 5,600 payroll jobs per month, resulting in a cumulative gain of 246,800 positions (+6.4 percent). At that rate, all else equal, it would take until January 2015 for the state to have as many payroll jobs as it did at the end of 2007.

The household data recorded since August offer further evidence of an underperforming labor market. Since that time, the statewide unemployment rate has fallen by 0.7 percentage points and has reached the lowest level (8 percent) recorded since late 2008. Yet much of the decline in the unemployment rate was due to people leaving the labor force rather than finding jobs. Between August and October, the size of the state’s labor force declined by 18,369 persons (-0.4 percent) and reached a level smaller than the one posted in October 2011.

The ongoing slides in two major measures of labor utilization provide additional evidence of people exiting the labor market altogether. Between August and October, the labor force participation rate, a key measure of labor utilization, fell steadily. In fact, the labor force participation rate has fallen in every month since January, and in October, it reached a monthly level—61.4 percent—lower than any figure posted at any time since 1976. Another important measure, the employment-to-population ratio, essentially managed to hold steady between August and October, but even then, the current ratio of 56.5 percent is only 0.2 percentage points above the 37-year low of 56.3 percent posted in the summer of 2011.

“Relatively little has changed in North Carolina’s labor market in the two months since the last release of statewide labor market data,” observed Quinterno. “At first glance, the steep decline in the unemployment rate seems promising, but scratch beneath the surface, and you will find a rate that is coming down for too many of the wrong reasons. North Carolina’s labor market simply continues to disappoint.”

22.11.2013

Policy Points

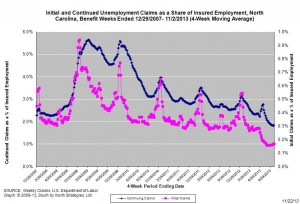

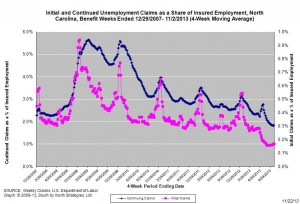

For the benefit week ending on November 2, 2013, North Carolinians filed some 7,115 initial claims for state unemployment insurance benefits and 71,033 claims for state-funded continuing benefits. Compared to the prior week, there were more initial claims and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 6,573 initial claims were filed over the previous four weeks, along with an average of 70,488 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, and the average number of continuing claims was higher.

One year ago, the four-week average for initial claims stood at 12,900, and the four-week average of continuing claims equaled 97,116.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.85 million versus 3.78 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were almost six years ago.

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. In fact, the four-week average of initial claims, when measured as a share of covered employment, is now at the lowest level recorded since early 2008. The four-week average of continuing claims also has fallen to the lowest level recorded since early 2008.

Note that the recent declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1. In time, this development also should reduce the number of continuing claims. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that eventually should lead to a reduction in the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (6,573) was 49 percent lower than the figure recorded one year ago (12,900), while the average number of continuing claims was 27.4 percent lower (70,488 versus 97,116). Given the relative lack of improvement in labor market condition in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

14.11.2013

Policy Points

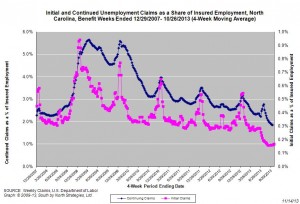

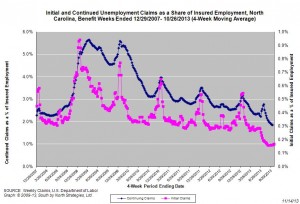

For the benefit week ending on October 26, 2013, North Carolinians filed some 6,877 initial claims for state unemployment insurance benefits and 70,053 claims for state-funded continuing benefits. Compared to the prior week, there were more initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 6,436 initial claims were filed over the previous four weeks, along with an average of 70,367 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 12,606, and the four-week average of continuing claims equaled 96,459.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.85 million versus 3.78 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were almost six years ago.

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. In fact, the four-week average of initial claims, when measured as a share of covered employment, is now at the lowest level recorded since early 2008. The four-week average of continuing claims also has fallen to the lowest level recorded since early 2008.

Note that the recent declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1. In time, this development also should reduce the number of continuing claims. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that eventually should lead to a reduction in the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (6,436) was 48.9 percent lower than the figure recorded one year ago (12,606), while the average number of continuing claims was 27 percent lower (70,367 versus 96,459). Given the relative lack of improvement in labor market condition in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

31.10.2013

Policy Points

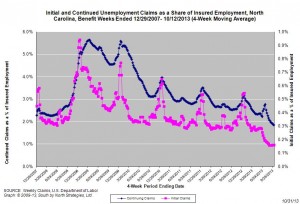

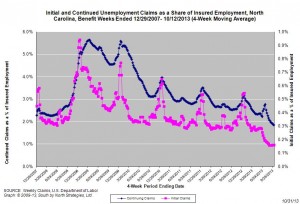

For the benefit week ending on October 12, 2013, North Carolinians filed some 6,083 initial claims for state unemployment insurance benefits and 70,775 claims for state-funded continuing benefits. Compared to the prior week, there were fewer initial claims and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 6,170 initial claims were filed over the previous four weeks, along with an average of 71,342 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 12,169, and the four-week average of continuing claims equaled 96,185.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.84 million versus 3.78 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were more than 5.5 years ago.

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. In fact, the four-week average of initial claims, when measured as a share of covered employment, is now at the lowest level recorded since early 2008. The four-week average of continuing claims also has fallen to the lowest level recorded since early 2008.

Note that the recent declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1. In time, this development also should reduce the number of continuing claims. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that eventually should lead to a reduction in the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (6,170) was 49.3 percent lower than the figure recorded one year ago (12,169), while the average number of continuing claims was 25.8 percent lower (71,342 versus 96,185). Given the relative lack of improvement in labor market condition in North Carolina over the past year, such declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed