11.07.2013

Policy Points

For the benefit week ending on June 22, 2013, some 9,570 North Carolinians filed initial claims for state unemployment insurance benefits and 76,031 individuals applied for state-funded continuing benefits. Compared to the prior week, there were fewer initial claims and fewer continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 10,787 initial claims were filed over the previous four weeks, along with an average of 86,573 continuing claims. Compared to the previous four-week period, the average number of initial claims was lower, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 11,080, and the four-week average of continuing claims equaled 99,681.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.82 million versus 3.76 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were 5.5 years ago.

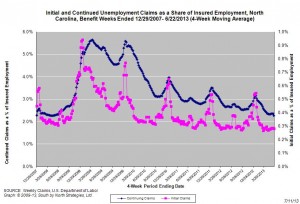

The graph shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims appear to have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. In fact, the four-week average of initial claims, when measured as a share of covered employment, is now at the lowest level recorded since early 2008. Yet continuing claims remain at an elevated level, which suggests that unemployed individuals are finding it difficult to find new positions.

10.07.2013

Policy Points

An editorial in today’s issue of The New York Times assesses some of the policy changes underway in North Carolina.

The cruelest decision by lawmakers went into effect last week: ending federal unemployment benefits for 70,000 residents. Another 100,000 will lose their checks in a few months. Those still receiving benefits will find that they have been cut by a third, to a maximum of $350 weekly from $535, and the length of time they can receive benefits has been slashed from 26 weeks to as few as 12 weeks.

…

The state has the fifth-highest unemployment rate in the country, and many Republicans insulted workers by blaming their joblessness on generous benefits. In fact, though, North Carolina is the only state that has lost long-term federal benefits, because it did not want to pay back $2.5 billion it owed to Washington for the program. The State Chamber of Commerce argued that cutting weekly benefits would be better than forcing businesses to pay more in taxes to pay off the debt, and lawmakers blindly went along, dropping out of the federal program.

09.07.2013

Policy Points

From the Economic Policy Institute’s analysis of the May 2013 version of the Job Openings and Labor Turnover Survey (JOLTS) …

In May, the number of job seekers, which increased by 101,000 from April, was 11.8 million (unemployment data are from the Current Population Survey … ). The “job-seekers ratio”—the ratio of unemployed workers to job openings—was unchanged in May at 3.1-to-1. The ratio has been 3.0-to-1 or greater since October 2008, more than four-and-a-half years ago. A job-seekers ratio above 3-to-1 means there are no jobs for more than two out of three unemployed workers. To put today’s ratio of 3.1-to-1 in perspective, the highest the ratio ever got in the early 2000s downturn was 2.9-to-1 in September 2003. In a labor market with strong job opportunities, the ratio would be close to 1-to-1, as it was in December 2000 (when it was 1.1-to-1).

05.07.2013

News Releases, Policy Points

CHAPEL HILL, NC (July 5, 2013) – The national labor market added in June 195,000 more jobs than it lost. The unemployment rate, however, was essentially unchanged from the prior month, as was the total number of unemployed Americans. Despite some welcome improvements in key indicators in recent months, unemployment and underemployment remain elevated, while the pace of job growth remains subdued relative to need.

“June was the 33rd-straight month of job growth recorded in the United States,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “Over the past twelve months, the national economy has netted an average of 191,000 jobs, a pace that, while positive, is insufficient to drive unemployment down to pre-recessionary levels. Four years into a recovery, the unemployment rate remains well above the pre-recessionary level of 5 percent.”

In June, the nation’s employers added 195,000 more payroll positions than they cut. Gains occurred entirely in the private sector (+202,000), while government employers eliminated 7,000 more positions than they added, owing chiefly to reductions by state governments. Moreover, the payroll employment numbers for April and May underwent positive revisions; with the updates, the economy gained 394,000 jobs over those two months, not the 324,000 positions previously reported.

Within the private sector, payroll levels rose the most in the leisure and hospitality services sector (+75,000, with 76.5 of the gain attributable to the accommodation and food services subsector), followed by the professional and business services sector (+53,000, with 72.6 percent of the gain occurring in the administrative and waste services subsector) and the trade, transportation, and utilities sector (+45,000, with 82.4 percent of the gains occurring in the retail trade subsector). Payroll levels fell the most in the manufacturing and information sectors (-6,000 and -5,000, respectively).

“Over the last year, the American economy gained 2.3 million more payroll positions that it lost,” noted Quinterno. “The current average monthly rate of job growth—some 191,000 positions per month—is better than the average logged during the prior 12-month period, but it nevertheless is insufficient to close the nation’s sizable jobs gap anytime soon.”

Slack labor market conditions were evident in the June household survey. Last month, 11.8 million Americans (7.6 percent of the labor force) were jobless and seeking work. Both the unemployment rate and total number of unemployed persons essentially were unchanged from the prior month. Also in June, the share of the population participating in the labor force rose to 63.5 percent, a rate lower than the one posted a year ago. On a positive note, more Americans were working in June compared to a year ago, and fewer persons were unemployed. At the same time, the share of the working age population with a job remained near the lowest figure recorded during the current business cycle.

Last month, the unemployment rate was higher among adult male workers than female ones (7 percent versus 6.8 percent). Unemployment rates were higher among Black (13.7 percent) and Hispanic workers (9.1 percent) than among white ones (6.6 percent). The unemployment rate among teenagers was 24 percent. Moreover, 6.3 percent of all veterans were unemployed; the rate among recent veterans (served after September 2001) was 7.2 percent. At the same time, 14.2 percent of Americans with disabilities were jobless and seeking work (not seasonally adjusted).

Jobs remained hard to find in June. Last month, the underemployment rate rose to 14.3 percent. Among unemployed workers, 36.7 percent had been jobless for at least six months, and the average spell of unemployment was 35.6 weeks. The leading cause of unemployment remained a job loss or the completion of a temporary job, which was the reason cited by 52.3 percent of unemployed persons. Another 28.1 percent of unemployed persons were reentrants to the labor market, while 10.8 percent were new entrants. Voluntary job leavers accounted for the remaining 8.8 percent of the total.

“The June employment report contained some good news about the state of the American labor market,” observed Quinterno. “The monthly job gain figure and the positive revisions to data from prior months were noteworthy, but unemployment and underemployment remained elevated. Despite having improved somewhat in recent months, measures of labor utilization remained at depressed levels, and long-term unemployment remains a serious problem.”

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed