05.01.2010

Policy Points

Economic policy reports, blog postings, and media stories of interest:

05.01.2010

Policy Points

The local employment report for November detailed few positive changes in local employment conditions across North Carolina.

In November, every part of the state experienced weak labor markets. Unemployment rates exceeded 10 percent in 68 counties, and in 33 counties, at least 12 percent of the labor force was jobless and actively seeking work. County unemployment rates ranged from 6.3 percent in Orange County to 16.6 percent in Edgecombe County. Altogether, unemployment in the state’s non-metropolitan counties was higher than in its metropolitan ones — 11.8 percent versus 10.2 percent.

Compared to one year ago, unemployment rates were higher in every North Carolina County and metro area. And compared to a year ago, 59 counties and 10 metro areas had smaller labor forces. Among metropolitan areas, Jacksonville posted the largest decline in the size of its labor force (-2.8 percent), followed by Hickory-Morganton-Lenoir (-1.2 percent) and Durham-Chapel Hill (-1 percent).

Click here to read South by North Strategies’ full analysis of the latest employment report.

05.01.2010

Policy Points

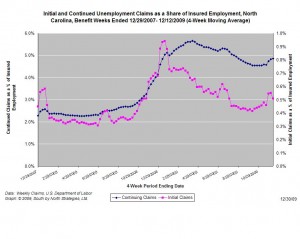

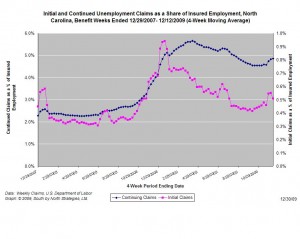

For the benefit week ending on December 12th, 16,223 North Carolinians filed initial claims for state unemployment insurance benefits, and 192,297 individuals applied for state-funded continuing insurance benefits. Compared to the prior week, there were fewer initial and continuing claims. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 20,113 initial claims were filed over the last four weeks, along with an average of 192,006 continuing claims. Compared to the previous four-week period, initial claims were lower and continuing claims were higher.

One year ago, the four-week average for initial claims stood at 27,210 and the four-week average of continuing claims equaled 154,790.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Although new and continuing claims appear to have peaked for this business cycle, the claims levels remain elevated and point to a labor market that remains extremely weak. Especially troubling is the high level of continuing claims, which suggests that unemployed individuals are finding it extremely difficult to find new positions.

30.12.2009

Policy Points

Between December 31 and January 4, Policy Points will be on hiatus for the New Year’s holiday. Regular posting will resume on January 5.

Thank you for your interest in the blog.

30.12.2009

Policy Points

Economic policy reports, blog postings, and media stories of interest:

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed