Policy Points

30.12.2009

Policy Points

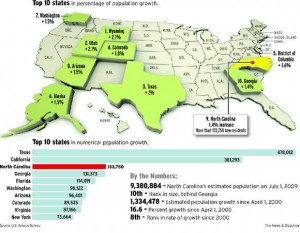

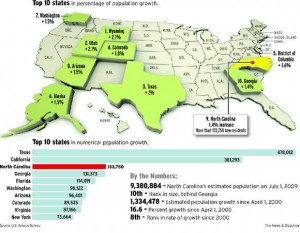

New estimates compiled by the U.S. Census Bureau show that net domestic migration slowed across much of the United States between July 1, 2008 and July 1, 2009. Over that period, Texas gained the most people in numerical terms (+478,000), followed by California (+381,000), North Carolina (+134,000), and Georgia (+131,000). In relative terms, Wyoming’s population grew the fastest (+2.12 percent), followed by Utah’s (+2.10 percent), and Texas’ (+1.97 percent) populations. (See map, right).

New estimates compiled by the U.S. Census Bureau show that net domestic migration slowed across much of the United States between July 1, 2008 and July 1, 2009. Over that period, Texas gained the most people in numerical terms (+478,000), followed by California (+381,000), North Carolina (+134,000), and Georgia (+131,000). In relative terms, Wyoming’s population grew the fastest (+2.12 percent), followed by Utah’s (+2.10 percent), and Texas’ (+1.97 percent) populations. (See map, right).

The 134,000 residents gained by North Carolina bring the state’s total population to 9.4 million. According to a report in The News & Observer, North Carolina is now the nation’s 10th most-populous state. Since 2000, North Carolina has gained over one million new residents and has seen its population grow at a rate faster than those recorded in all but seven other states. However, owing in large part to the recession, North Carolina did not grow as robustly last year as it has in recent ones.

29.12.2009

Policy Points

Economic policy reports, blog postings, and media stories of interest:

29.12.2009

In the News, Policy Points

In a recent cover story, The Asheville (N.C.) Citizen-Times reviewed the economic trends that buffeted North Carolina, especially its western region, during 2009 and asked what 2010 might hold for businesses, individuals, and communities. Along with other experts, the piece featured the perspective of South by North Strategies’ John Quinterno.

Said the article about the strength of an economic recovery:

“Unfortunately, although there have been signs of improvement in the economy, no one can say with complete confidence just when the bad times will end — or what the ‘new normal’ on the other side of the recession will be.

…

‘Talk of an economic recovery is exaggerated,’ said John Quinterno, head of South by North Strategies, an economic research and communications firm based in Chapel Hill. ‘I do think conditions are better than they were six months ago or a year ago. That’s not really saying much.’

And said the article about the current state of the labor market:

The figures understate the ills in the local job market as some people are not counted as unemployed because they have simply given up looking for work.

…

They also don’t reveal the psychological impact joblessness has on people in a culture in which, according to Quinterno, people tend to view being unemployed as the fault of an individual rather than reflective of problems in the economy as a whole.

…

Being without work ‘goes to people’s self-worth and dignity,” Quinterno said. ‘It’s nonmonetary, but it has a huge, devastating impact on people.’

29.12.2009

Policy Points

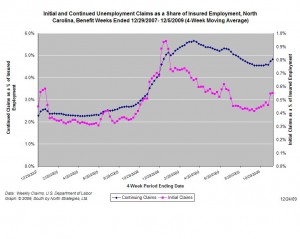

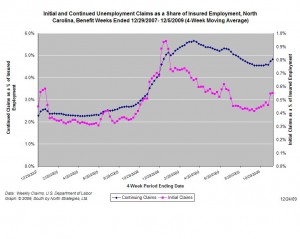

For the benefit week ending on December 5th, 17,994 North Carolinians filed initial claims for unemployment insurance, and 192,669 individuals applied for continuing insurance benefits. Compared to the prior week, there were fewer initial and continuing claims. These figures come from data released today by the U.S. Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 21,743 initial claims were filed over the last four weeks, along with an average of 190,762 continuing claims. Compared to the previous four-week period, both initial and continuing claims were higher.

One year ago, the four-week average for initial claims stood at 26,483 and the four-week average of continuing claims equaled 148,544.

The graph (right) shows the changes in unemployment insurance claims (as a share of covered employment) in North Carolina since the recession’s start in December 2007.

Although new and continuing claims appear to have peaked for this business cycle, the claims levels remain elevated and point to a labor market that remains extremely weak. Especially troubling is the high level of continuing claims, which suggests that unemployed individuals are finding it extremely difficult to find new positions.

23.12.2009

Policy Points

Between December 24 and December 28, Policy Points will be on hiatus for the Christmas holiday. Regular posting will resume on December 29.

Thank you for your interest in the blog.

New estimates compiled by the U.S. Census Bureau show that net domestic migration slowed across much of the United States between July 1, 2008 and July 1, 2009. Over that period, Texas gained the most people in numerical terms (+478,000), followed by California (+381,000), North Carolina (+134,000), and Georgia (+131,000). In relative terms, Wyoming’s population grew the fastest (+2.12 percent), followed by Utah’s (+2.10 percent), and Texas’ (+1.97 percent) populations. (See map, right).

New estimates compiled by the U.S. Census Bureau show that net domestic migration slowed across much of the United States between July 1, 2008 and July 1, 2009. Over that period, Texas gained the most people in numerical terms (+478,000), followed by California (+381,000), North Carolina (+134,000), and Georgia (+131,000). In relative terms, Wyoming’s population grew the fastest (+2.12 percent), followed by Utah’s (+2.10 percent), and Texas’ (+1.97 percent) populations. (See map, right).

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed