US Labor Market Conditions Improved In Dec.

CHAPEL HILL, NC (January 9, 2015) – In December, the national labor market added 252,000 more jobs than it lost due primarily to gains in the private sector. And in December, the unemployment rate fell to 5.6 percent. Unfortunately, 71 percent of the decline in the number of unemployed Americans was due to a decrease in in the size of the labor force. Joblessness consequently remains a serious economic and social problem.

“December was the 51st-straight month in which the United States experienced net job growth,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “Over the year, the economy netted an average of 246,000 jobs per month, a pace that has mitigated but has not undone the damage inflicted to the labor market by the last recession.”

In December, the nation’s employers added 252,000 more payroll jobs than they cut. Some 95 percent of the gain originated in the private sector (+240,000), while public employers added 12,000 more positions than they cut. Within the private sector, payroll levels increased the most in the professional and business services sector (+52,000, with 67.7 percent of the gain occurring in the administrative and waste services subsector), followed by the construction and education and health services sectors (both +48,000). Payroll levels in all other major industry groups rose in December or essentially held steady.

Additionally, the payroll employment numbers for October and November underwent revisions; with the updates, the economy netted 614,000 jobs over those two months, not the 564,000 positions previously reported. With those changes, the average pace of monthly job growth in the United States recorded over the past year rose to 246,000.

“The United States has experienced steady job growth for over four years, but the pace of growth has been modest relative to the country’s needs,” noted Quinterno. “While the United States has more payroll jobs than it did in December 2007, the current average monthly rate of job growth is insufficient to close the jobs gap caused by the recession—a gap now estimated at 5.6 million jobs—anytime soon.”

Data from the household survey offered mixed news about the health of the United States’ labor market. In December, the number of Americans who were employed increased by 111,000 persons (+0.1 percent). At the same time, the overall size of the labor force decreased by 273,000 persons (-0.2 percent) between November and December. Meanwhile, the share of working-age Americans participating in the labor force fell in December, while the share of working-age Americans with a job was unchanged.

In December, 8.7 million Americans were unemployed (5.6 percent), down 4.2 percent from November. Another 6.8 million individuals worked part time despite preferring full-time positions, and an additional 740,000 individuals (not seasonally adjusted) were so discouraged about their job prospects that they had stopped searching for work altogether. Those persons were part of a larger population of 2.3 million Americans who were marginally attached to the labor force.

Compared to a year ago, 2.8 million more Americans were working in December, and 1.7 million fewer persons were unemployed. At the same time, the share of the working-age population with a job (59.2 percent) remained at a depressed level, while the share of the population that was participating in the labor force fell to 62.7 percent from 62.8 percent.

Last month, the unemployment rate was higher for adult male workers than adult female workers (5.3 percent versus 5 percent). Unemployment rates were higher among Black (10.4 percent) and Hispanic workers (6.5 percent) than among white ones (4.8 percent). The unemployment rate among teenagers was 16.8 percent.

Additionally, 4.7 percent of all veterans were unemployed in December, and the rate among recent veterans (served after September 2001) was 6.9 percent. At the same time, 11.2 percent of Americans with disabilities were jobless and seeking work (not seasonally adjusted).

Jobs remained comparatively hard to find in December. Last month, the underemployment rate equaled 11.2 percent, down from the 13.1 percent rate logged a year ago. Among unemployed workers, 31.9 percent had been jobless for at least six months, as opposed to 37.3 percent a year earlier. And the average spell of unemployment equaled 32.8 weeks, down from 36.8 weeks in December 2013.

In December, the leading cause of unemployment remained a job loss or the completion of a temporary job, which was the reason cited by 49.2 percent of unemployed persons. Another 30.7 percent of unemployed persons were re-entrants to the labor market, while 11 percent were new entrants. Voluntary job leavers accounted for the remaining 9.1 percent of the total.

“The December employment report offered a portrait of a national job market that is improving yet is by no means healed,” observed Quinterno. “Weak labor market conditions, in turn, are preventing American workers from experiencing improvements in their wages and living standards.”

Local Unemployment Rates Down Across NC

CHAPEL HILL, NC (December 30, 2014) – Between November 2013 and November 2014, unemployment rates fell in all 100 counties in North Carolina and in all 14 of the state’s metropolitan areas. Yet over the same period, the size of the local labor force shrank in 89 counties and in 12 metro areas.

These findings come from new estimates released today by the Labor and Economic Analysis Division of the North Carolina Department of Commerce.

“Local unemployment rates declined, often sharply, across much of North Carolina over the past year,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “At the same time, the reductions do not alter the fact that unemployment remains a pressing economic and problem almost seven years after the onset of the last recession.”

Compared to December 2007, which is when the national economy fell into recession, North Carolina now has 0.8 percent more payroll jobs (+34,900). In November, the state gained 16,400 more jobs than it lost (+0.4 percent). Since bottoming out in February 2010, the state’s labor market has netted some 6,400 jobs per month, resulting in a cumulative gain of 363,700 positions (+9.5 percent).

Between October and November of 2014, local unemployment rates decreased in 72 of the state’s 100 counties, increased in 20 counties, and held constant in eight counties. Individual county rates in November ranged from 3.7 percent in County to 11.4 percent in Graham County. Overall, 2 counties posted unemployment rates greater than or equal to 10 percent, and 41 counties posted rates between 6 and 9.9 percent.

“Non-metropolitan labor markets continue to trail metropolitan ones,” noted Quinterno. “In November, 6 percent of the non-metro labor force was unemployed, compared to 5.1 percent of the metro labor force. Compared to December 2007, the non-metro labor force now has 5.7 percent fewer employed persons, while the number of unemployed individuals is 1.5 percent larger. Over that time, the size of the non-metro labor force has fallen by 5.3 percent. In fact, North Carolina’s total labor force in November would have been 1.5 percent larger if the size of the non-metropolitan labor force had held steady at its pre-recession level, all else being equal.”

Between October and November, unemployment rates fell in all of the state’s 14 metro areas. Rocky Mount had the highest unemployment rate (7.9 percent), followed by Fayetteville (6.2 percent) and Goldsboro (5.8 percent). Asheville had the lowest unemployment rate (4 percent), followed by Durham-Chapel Hill and Raleigh-Cary (both 4.3 percent).

Compared to November 2013, unemployment rates in November 2014 were lower in all 100 counties and in all 14 metro areas. Over the year, however, labor force sizes decreased in 89 counties and in 12 metros. And the statewide labor force (seasonally adjusted) was 0.7 percent smaller (-31,665 individuals) in November 2014 than it was in November 2013.

Among metros, Rocky Mount’s labor force contracted at the fastest rate (-3.6 percent) over the course of the year, followed by Fayetteville (-2.9 percent) and Hickory-Morganton-Lenoir (-2.8 percent). With those changes, metro areas now are home to 72.5 percent of the state’s labor force, with 51.3 percent of the labor force residing in the Triangle, Triad, and Charlotte metros.

In the long term, improvements in overall labor market conditions depend on growth in the Charlotte, Research Triangle, and Piedmont Triad regions. Collectively, employment in the three metro regions has risen by 6.7 percent since December 2007, and the combined unemployment rate in November totaled 4.9 percent, as compared to 6.8 percent in November 2008. Of the three broad regions, the Research Triangle had the lowest unemployment rate (4.4 percent), followed by the Piedmont Triad (5.2 percent) and Charlotte (5.4 percent).

The local employment report for November also provided insights into the effects of the extensive changes to the state’s system of unemployment insurance implemented in 2013. Last month, the number of regular unemployment insurance initial claims filed in North Carolina totaled 20,011, down from the 26,273 initial claims filed a year earlier (-23.4 percent).

Mecklenburg County was home to greatest number of regular initial claims (2,039), followed by Wake (1,494), Guilford (1,014), Cumberland (692), and Forsyth (598) counties.

In November 2014, North Carolinians received a (nominal) total of $27 million in regular state-funded and federal unemployment insurance compensation, down from the (nominal) $55.7 million received in November 2013. This decline (-51.5 percent) is attributable to a mix of factors, such as drops in the number of insurance claims resulting from economic improvements and legal changes that restricted eligibility for insurance compensation.

“Many labor markets across North Carolina have experienced improvements over the past year,” said Quinterno. “While those improvements are important, they must not obscure the fact that many local labor markets—non-metropolitan ones in particular—continue to underperform and have not yet recovered from the last recession.”

US Labor Market Nets Jobs In November

CHAPEL HILL, NC (December 5, 2014) – In November, the national labor market added 321,000 more jobs than it lost due primarily to gains in the private sector. Also in November, the unemployment rate held steady at 5.8 percent. While numerous labor market conditions have improved over the past year, joblessness remains a problem in the United States.

“November was the 50th-straight month in which the United States experienced net job growth,” said John Quinterno, a principal with South by North Strategies, Ltd., a research firm specializing in economic and social policy. “Over the year, the economy netted an average of 228,000 jobs per month, a pace that reduced—but did not fully repair—the damage inflicted on the national labor market during the last recession.”

In November, the nation’s employers added 321,000 more payroll jobs than they cut. Some 98 percent of the gain originated in the private sector (+314,000), while public employers added 7,000 more positions than they cut. Within the private sector, payroll levels increased the most in the professional and business services sector (+86,000, with 48.5 percent of the gain occurring in the administrative and waste services subsector), followed by the trade, transportation, and utilities sector (+71,000, with 70.7 percent of the gain originating in the retail trade subsector) and the education and health services sector (+38,000, with 76.1 percent of the gain originating in the health care subsector.

Payroll levels in all other major industry groups either rose in November or were unchanged from the October levels.

Additionally, the payroll employment numbers for September and October underwent revisions; with the updates, the economy netted 514,000 jobs over those two months, not the 470,000 positions previously reported. With those changes, the average pace of monthly job growth in the United States recorded over the past year rose to 228,000.

“The United States has experienced steady job growth for over four years, but the pace of growth has been modest relative to the country’s needs,” noted Quinterno. “While the United States has more payroll jobs than it did in December 2007, the current average monthly rate of job growth is insufficient to close the jobs gap caused by the recession—a gap now estimated at a little under 6 million jobs—anytime soon.”

Data from the household survey offered mixed news about the health of the United States’ labor market. In November, the number of Americans who were employed was essentially no different than it was in October. At the same time, the overall size of the labor force rose by 119,000 persons (+0.1 percent) between October and November. Meanwhile, the share of working-age Americans participating in the labor force held steady in November, as did the share of working-age Americans with a job.

In November, 9.1 million Americans were unemployed (5.8 percent), while 6.9 million individuals worked part time despite preferring full-time positions. Another 698,000 individuals (not seasonally adjusted) were so discouraged about their job prospects that they had stopped searching for work altogether. Those persons were part of a larger population of 2.1 million Americans who were marginally attached to the labor force.

Compared to a year ago, 2.8 million more Americans were working in November, and 1.7 million fewer persons were unemployed. At the same time, the share of the working-age population with a job (59.2 percent) remained at a depressed level, while the share of the population that was participating in the labor force fell to 62.8 percent from 63 percent.

Last month, the unemployment rate was higher for adult male workers than adult female workers (5.4 percent versus 5.3 percent). Unemployment rates were higher among Black (11.1 percent) and Hispanic workers (6.6 percent) than among white ones (4.9 percent). The unemployment rate among teenagers was 17.7 percent.

Additionally, 4.5 percent of all veterans were unemployed in November, and the rate among recent veterans (served after September 2001) was 5.7 percent. At the same time, 10.8 percent of Americans with disabilities were jobless and seeking work (not seasonally adjusted).

Jobs remained comparatively hard to find in November. Last month, the underemployment rate equaled 11.4 percent, down from the 13.1 percent rate logged a year ago. Among unemployed workers, 30.7 percent had been jobless for at least six months, as opposed to 37.4 percent a year earlier. And the average spell of unemployment equaled 33 weeks, down from 37.1 weeks in November 2013.

In November, the leading cause of unemployment remained a job loss or the completion of a temporary job, which was the reason cited by 49 percent of unemployed persons. Another 30.3 percent of unemployed persons were re-entrants to the labor market, while 11.6 percent were new entrants. Voluntary job leavers accounted for the remaining 9.1 percent of the total.

“The November employment report offered a portrait of a national job market that is improving yet remains far from healed,” observed Quinterno. “Weak growth, in turn, is preventing American workers from experiencing improvements in their wages and living standards despite the fact that they have become more economically productive.”

NC Unemployment Claims: Week Of 11/15/14

For the benefit week ending on November 15, 2014, North Carolinians filed some 5,557 initial claims for state unemployment insurance benefits and 39,504 claims for state-funded continuing benefits. Compared to the prior week, there were more initial claims and more continuing claims. These figures come from data released by the US Department of Labor.

Averaging new and continuing claims over a four-week period — a process that helps adjust for seasonal fluctuations and better illustrates trends — shows that an average of 5,219 initial claims were filed over the previous four weeks, along with an average of 40,496 continuing claims. Compared to the previous four-week period, the average number of initial claims was higher, and the average number of continuing claims was lower.

One year ago, the four-week average for initial claims stood at 6,772, and the four-week average of continuing claims equaled 70,962.

In recent months covered employment has increased and now exceeds the level recorded a year ago (3.92 million versus 3.86 million). Nevertheless, there are still fewer covered workers than there were in January 2008, which means that payrolls are smaller today than they were almost 7 years ago.

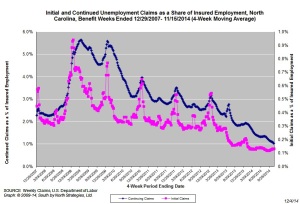

The graph (below right) shows the changes in unemployment insurance claims measured as a share of covered employment in North Carolina since the recession’s start in December 2007.

Both new and continuing claims have peaked for this cycle, and the four-week averages of new and continuing claims have fallen considerably. The four-week average of initial claims, when measured as a share of covered employment, is near the lowest level recorded since early 2008, while the four-week average of continuing claims is at the lowest level recorded since early 2008.

Note that the recent year-over-year declines in new and continuing claims are not necessarily indicative of an improving labor market. State legislation that took effect on July 1, 2013, made major changes to insurance eligibility criteria, and the more stringent criteria eliminate claims that would have been valid prior to July 1, 2013. Additionally, the legislation reduced the maximum number of weeks of state-funded insurance for which a claimant is eligible — an action that reduces the number of continuing claims.

To place the numbers in context, consider how the four-week average of initial claims (5,219) was 22.9 percent lower than the figure recorded one year ago (6,772), while the average number of continuing claims was 42.9 percent lower (40,496 versus 70,962). Given the modest rate of job growth that has occurred in North Carolina over the past year, such large declines likely are products of changes to unemployment insurance laws rather than improvements in underlying economic conditions.

Email Sign-Up

Email Sign-Up RSS Feed

RSS Feed